Mastering Money Management: A Journey to Financial Freedom

The financial landscape is rapidly evolving, especially for Gen Z and Gen Alpha. These digital natives are growing up with AI-driven technologies that simplify financial tasks and enhance decision-making.

When you think about your dreams and glance at your bank account, you might feel a disconnect. “My bank account does not align with my dreams,” you sigh. This is a common sentiment across the globe. According to recent data, 46% of Americans would struggle to come up with $400 for an emergency. Additionally, 60% face such emergencies annually. Clearly, money management is a universal concern.

But here’s the good news—by improving your relationship with money, you can align your finances with your aspirations. Let’s explore six actionable lessons that can help you master money management, supported by the latest tools and techniques.

1. Talk About Money

Financial stress often stems from isolation. Money conversations are taboo in many cultures, leading to shame and anxiety. Breaking this silence is essential. Gather your trusted circle—friends, family, or a support group—and start an open dialogue. No judgment, no shame, just shared experiences and encouragement. This collective approach to money management fosters accountability and shared learning.

2. Understand What Money Is

Money is not an end in itself but a tool to achieve your goals. Whether it’s buying your first home, traveling, or securing a comfortable retirement, money is a means to an end. Understanding this shifts your focus from accumulation to purposeful use.

3. Identify and Visualize Your Goals

Ask yourself: What am I saving for? Whether it’s a car, debt repayment, or a rainy-day fund, clarity on your goals is crucial. Visual tools like a vision board can be transformative. Gather images that represent your goals—that dream vacation, a debt-free life, or a cozy home—and place them where you’ll see them daily. This constant reminder aligns your daily habits with your financial aspirations.

4. It’s Not About What You Make, But What You Keep

Financial success isn’t solely about income; it’s about managing your expenses and savings. Start with basics:

- Automate Savings: Set up an automatic transfer to your savings account.

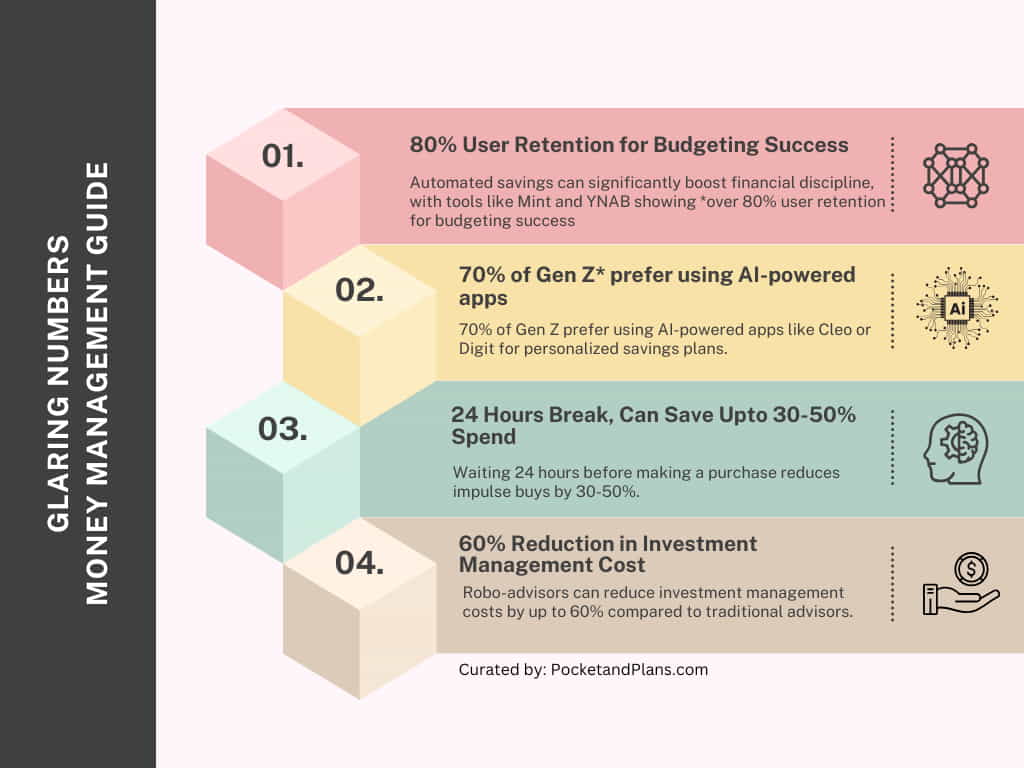

- Utilize Best Money Management Apps: Apps like Mint, YNAB, and Personal Capital help track your spending and manage budgets effectively. Robo-advisors can reduce investment management costs by up to 60% compared to traditional advisors.

- Impulse Control Tip: Add items to your cart but wait 24 hours before purchasing. Often, you’ll realize you don’t need them. Waiting 24 hours before making a purchase reduces impulse buys by 30-50%.

5. Leverage High-Yield Savings Accounts

Boost your financial growth by using high-yield savings accounts. Banks like Chase and PayPal offer competitive rates for short-term and long-term savings. For those planning a future investment, consider government savings bonds or a health savings account to reduce taxable income and build a financial cushion.

6. Be Kind to Yourself

Your self-worth is not tied to your net worth. Celebrate every financial milestone, no matter how small, and approach setbacks with grace. Money management is a journey, not a race. Progress, not perfection, is the goal.

7. Use AI Powered Personalized Tools

Here are some trends shaping tools developing the future of personalized money management:

- AI-Powered Personal Finance Apps: Tools like Cleo and Digit use AI to analyze spending patterns, offer tailored savings plans, and provide real-time financial advice. 70% of Gen Z prefer using AI-powered apps like Cleo or Digit for personalized savings plans.

- Cryptocurrency and Decentralized Finance (DeFi): Younger generations are exploring decentralized finance platforms for investments and savings, bypassing traditional banking systems.

- Gamification of Savings: Apps like Acorns and Qoins use gamification to make saving money more engaging, aligning perfectly with the interests of Gen Z and Gen Alpha. Apps like Acorns report that users who round up their purchases save an average of $250-300 per month.

- Financial Literacy Through Social Media: Platforms like TikTok and YouTube are becoming hubs for bite-sized personal finance education, reaching millions globally. Personal finance influencers on TikTok and YouTube have a combined reach of over 1 billion viewers annually.

Why Personalized AI Tools Necessary for MMS

AI is revolutionizing the way we approach money management. Imagine using:

- AI-Driven Budgeting Tools: These apps predict your expenses, suggest areas to cut costs, and automatically allocate savings.

- Smart Investments: AI-powered robo-advisors analyze market trends and manage investment portfolios with precision.

- Voice-Activated Financial Assistants: Tools like Amazon Alexa or Google Assistant are evolving to include financial management features, enabling users to check balances, transfer funds, or set savings goals through voice commands.

Moreover, as blockchain technology matures, secure and transparent financial transactions will become the norm, further empowering individuals to take control of their financial futures.

8. List of Essential Tools for Money Management

Here’s a curated list of the best money management tools and apps to keep you on track:

- Best Money Management Apps:

- Mint: For budgeting and bill tracking

- YNAB (You Need A Budget): For proactive financial planning

- Personal Capital: For investment tracking and net worth calculation

- Savings Accounts:

- Best online savings accounts: Ally, Marcus by Goldman Sachs

- Instant access savings: Ideal for emergency funds

- Kids savings accounts: Start teaching financial literacy early

Summary of Impact of AI on Money Management

Conclusion

By implementing these practical strategies and using modern money management tools, you can take control of your finances and transform your dreams into reality. Money management is not about deprivation; it’s about aligning your resources with what truly matters. With AI and other emerging technologies, the future of finance promises even more accessible and efficient ways to grow your wealth. Start today, and watch your financial future flourish.

One Response