Introduction: The Problem with Budgeting

For many beginners, creating a budget feels overwhelming, like a complicated math problem with no clear answer. If you’re tired of living paycheck to paycheck or struggling to save for future goals, you’re not alone. According to a recent 2025 CNBC survey, nearly 60% of adults in the U.S. live without a proper budget, leading to financial stress and missed opportunities. The good news? Budgeting doesn’t have to be hard or time-consuming. In this article, we’ll explore 10 simple budgeting techniques for beginners that can help you save money, reduce stress, and take control of your financial future.

Key Statistics and Insights

Did You Know?

- 90% of Americans feel better about their finances when they budget. (CNBC, 2025)

- Households that follow the 50/30/20 rule save 20% more annually compared to those who don’t.

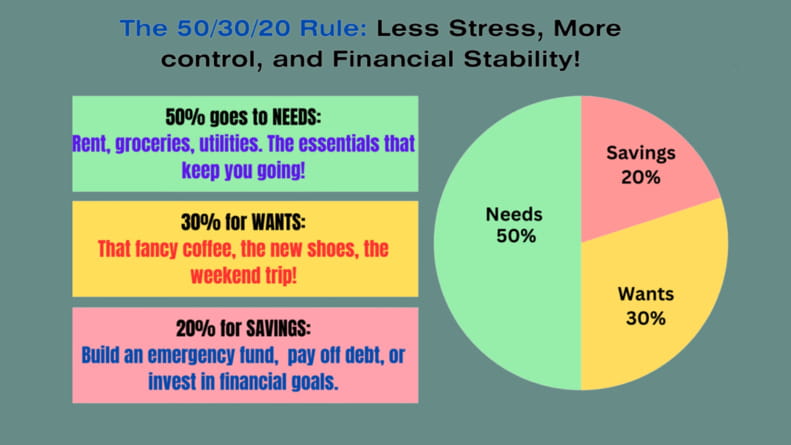

Use the 50/30/20 Budget Rule

What It Is: This simple rule divides your income into three categories:

- 50% for Needs: Rent, utilities, groceries.

- 30% for Wants: Dining out, subscriptions, entertainment.

- 20% for Savings: Emergency funds, investments, debt repayment.

Why It Works: It’s straightforward and adaptable. By focusing on just three categories, you can avoid the paralysis of over-detailing expenses.

Pro Tip: Use apps like Mint or YNAB to automate this budgeting system.

Track Every Expense for 30 Days

Start by writing down or logging every purchase you make for a month. Categorize them into needs, wants, and discretionary spending.

Pain Point Solved: Most people underestimate their discretionary spending, especially on subscriptions and dining out.

Tools to Try: Free apps like Spendee or PocketGuard. For more help, you can check template guide here

Example Table:

| Category | Average Monthly Spending | Adjusted Spending Goal |

|---|---|---|

| Groceries | $500 | $450 |

| Dining Out | $200 | $100 |

| Subscriptions | $50 | $30 |

Leverage Cash-Only Envelopes for Spending

What It Is: Assign physical envelopes to budget categories and use cash instead of cards.

Why It Works: Research shows using cash reduces impulse purchases by 18% (Behavioral Science Journal, 2023).

Modern Alternative: If you prefer digital solutions, apps like Goodbudget mimic this system.

Automate Your Savings

Set up automatic transfers from your checking account to a savings account each payday.

- Start Small: Even $25 per paycheck adds up over time.

- Impactful Tip: Open a high-yield savings account with banks like Ally or Marcus by Goldman Sachs offering rates above 4% APY in 2025.

Identify and Cut Unnecessary Subscriptions

Streaming services, gym memberships, or meal kits can silently drain your finances.

How to Do It:

- Review monthly bank statements.

- Use apps like Truebill to cancel unused subscriptions.

Set SMART Financial Goals

Your goals should be Specific, Measurable, Achievable, Relevant, and Time-bound.

Example SMART Goal: Save $5,000 for an emergency fund in 12 months by saving $417 per month.

Helpful Tool: Use this calculator for SMART goals: SMART Goals Planner.

Use Budgeting Apps

Apps can simplify budgeting and track your progress automatically.

- Top Picks for 2025:

- You Need a Budget (YNAB): Ideal for zero-based budgeting.

- Mint: Great for beginners with intuitive categorization.

- EveryDollar: Inspired by Dave Ramsey The Total Money Makeover principles.

Build an Emergency Fund First

Aim for 3-6 months of living expenses as a safety net.

Why It’s Crucial: Emergencies like job loss or medical expenses are among the leading causes of financial stress (Forbes, 2024).

Create a Sinking Fund for Big Expenses

Instead of putting big-ticket items on credit, save incrementally.

How It Works: Want a $1,200 vacation next year? Save $100/month in a dedicated account.

Regularly Review and Adjust Your Budget

Your financial situation changes over time.

Review Tips:

- Set a monthly reminder to review spending.

- Adjust categories based on seasonal expenses (e.g., holidays).

Conclusion: Start Your Budgeting Journey Today

Budgeting is more than a financial strategy—it’s a mindset shift. By using these 10 simple budgeting techniques, you can take control of your finances, reduce stress, and achieve financial freedom. Start small, stay consistent, and watch how small changes make a big impact.

3 Responses