Introduction to Kaikebo: A Time-Tested Japanese Technique

Kaikebo, a traditional Japanese method of financial management, has been used for decades to help households and individuals manage their money effectively. Rooted in simplicity and discipline, Kaikebo emphasizes tracking expenses, setting budgets, and prioritizing savings. In today’s fast-paced, capitalist world, where financial stress is rampant, Kaikebo offers a structured approach to money management that can benefit everyone, especially the middle class and lower-income groups.

This blog explores the principles of Kaikebo, compares it to modern financial tools like budgeting apps and expense trackers, and provides actionable tips to integrate this technique into your daily life.

What is Kaikebo?

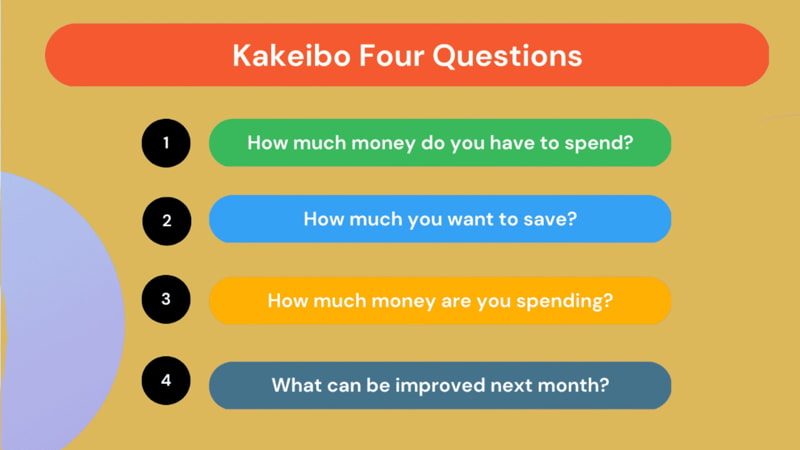

Kaikebo (家計簿) translates to “household account book” in Japanese. It is a manual system of recording income and expenses to gain clarity on spending habits and improve financial control. The core principles of Kaikebo, answer following questions, which includes:

- Tracking Every Expense: Writing down all expenditures to identify patterns.

- Categorizing Spending: Dividing expenses into categories like groceries, utilities, and entertainment.

- Setting Monthly Budgets: Allocating specific amounts to each category.

- Prioritizing Savings: Setting aside a portion of income before spending.

Kaikebo vs. Modern Financial Tools

Traditional Kaikebo

- Pros:

- Encourages mindfulness and discipline in spending.

- No need for technology or internet access.

- Helps build a habit of manual tracking, which can improve financial awareness.

- Cons:

- Time-consuming and requires consistent effort.

- Limited ability to analyze data or generate insights.

Modern Budgeting Apps

- Pros:

- Automates expense tracking and categorization.

- Provides real-time insights into spending habits.

- Offers features like debt management, savings goals, and financial risk management.

- Cons:

- May require a subscription fee for premium features.

- Reliance on technology can be a barrier for some users.

Table 1: Kaikebo vs. Modern Budgeting Apps

| Feature | Kaikebo | Modern Budgeting Apps |

|---|---|---|

| Expense Tracking | Manual | Automated |

| Data Analysis | Limited | Advanced |

| Accessibility | Pen and paper | Smartphone or computer |

| Cost | Free | Free or paid (premium) |

| Financial Insights | Basic | Comprehensive |

Source: Financial Management Analysis, 2024

How Kaikebo Fits into Modern Financial Management

1. Financial Control in a Capitalist World

In a capitalist society, consumerism and easy access to credit can lead to overspending and debt. Kaikebo’s emphasis on tracking expenses and setting budgets helps individuals regain control over their finances. By combining Kaikebo with modern tools like expense tracker apps, you can achieve a balance between tradition and technology.

2. Benefits for Middle-Class and Lower-Income Groups

- Reduces Financial Stress: By tracking expenses, individuals can identify unnecessary spending and redirect funds toward savings.

- Encourages Savings: Kaikebo’s focus on prioritizing savings helps build an emergency fund, which is crucial for financial stability.

- Debt Management: By setting clear budgets, individuals can avoid overspending and manage existing debt more effectively.

Integrating Kaikebo with Modern Budgeting Apps & Blogs

Top Budgeting Apps to Complement Kaikebo

Here are some of the best budget apps and expense tracker apps that align with Kaikebo principles:

Table 2: Best Budgeting Apps for 2023

| App Name | Key Features | Best For |

|---|---|---|

| YNAB (You Need A Budget) | Goal setting, debt management, real-time tracking | Comprehensive financial management |

| Mint | Expense tracking, bill reminders, credit score monitoring | Beginners and casual users |

| PocketGuard | Spending insights, savings goals, bill tracking | Simplifying budgeting |

| Goodbudget | Envelope budgeting, expense sharing | Families and couples |

| Pocket & Plans | Encompass of personal finance, budgeting & side hustle ideas | Individuals & Side Hustlers |

| HandWallet | Expense manager, bill tracking, multi-currency support | International users |

Source: Top Budget Apps Review, 2024

How to Start Using Kaikebo Today

Step 1: Set Up Your Kaikebo System

- Use a notebook or spreadsheet to record income and expenses.

- Create categories for your spending (e.g., housing, food, transportation).

Step 2: Track Every Expense

- Write down every purchase, no matter how small.

- Use a free budget app like Mint or Goodbudget to automate tracking.

Step 3: Analyze and Adjust

- At the end of the month, review your spending and identify areas for improvement.

- Adjust your budget for the next month based on your findings.

Kaikebo for Specific Financial Goals

1. Managing Debt

- Use Kaikebo to allocate a portion of your income toward debt repayment.

- Combine it with debt management tools in apps like YNAB or PocketGuard.

2. Building Savings

- Prioritize savings by setting aside a fixed percentage of your income.

- Use savings goals features in apps like Mint or HandWallet.

3. Financial Risk Management

- Create an emergency fund to protect against unexpected expenses.

- Use financial risk management tools to assess and mitigate risks.

Conclusion: Embrace Kaikebo for Financial Stability

Kaikebo is more than just a budgeting technique; it’s a mindset that promotes financial discipline and mindful spending. By combining this traditional Japanese method with modern budgeting apps and expense trackers, you can achieve comprehensive personal finance management.

Whether you’re part of the middle class, lower-income group, or simply looking to improve your financial health, Kaikebo offers a practical and effective way to manage debt, track expenses, and build savings. Start your Kaikebo journey today and take control of your financial future.

FAQs

1. What is Kaikebo?

Kaikebo is a Japanese technique for financial management that involves tracking expenses, setting budgets, and prioritizing savings.

2. How does Kaikebo compare to modern budgeting apps?

Kaikebo is a manual system that emphasizes mindfulness, while modern apps offer automation and advanced insights. Combining both can provide the best of both worlds.

3. What are the best budgeting apps to use with Kaikebo?

Some of the best budget apps include YNAB, Mint, PocketGuard, and Goodbudget.

4. Can Kaikebo help with debt management?

Yes, Kaikebo’s focus on budgeting and tracking expenses can help individuals manage and reduce debt effectively.

5. Is Kaikebo suitable for lower-income groups?

Absolutely. Kaikebo’s simplicity and focus on savings make it an excellent tool for improving financial stability, regardless of income level.

By integrating Kaikebo with modern tools like expense tracker apps and personal finance apps, you can achieve a balanced approach to money management that meets the demands of today’s world. Start your journey toward financial freedom today!